Market Update: March 2024

Market Update: Q1 2024

Consider a turkey that is fed every day. Every single feeding will firm up the bird’s belief that it is the general rule of life to be fed every day by friendly members of the human race “looking out for its best interests,” as a politician would say. On the afternoon of the Wednesday before Thanksgiving, something unexpected will happen to the turkey. It will incur a revision of belief.

― Nassim Nicholas Taleb, The Black Swan: The Impact of the Highly Improbable

Since bottoming out in October last year markets have been in a steady ascent, reaching all time highs. I’ll take it. Makes my job much easier.

Still, every time conditions are this good, I can’t help but worry that disaster waits lurking around the corner. Are we turkeys on the verge of incurring “a revision of belief”?

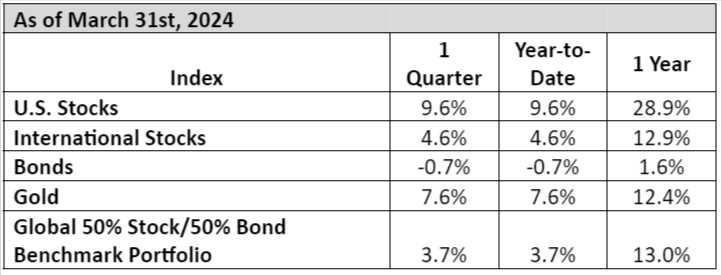

Global Indices

- U.S. stocks outperformed international stocks. The so called Magnificent 7 has become the Magnificent 4 with Amazon, Meta, Microsoft and Nvidia accounting for 75% of the U.S. stock market’s return so far in 2024.

- Bonds were down again as interest rates rose. It’s becoming increasingly clear that the Federal Reserve is going to struggle to get inflation back down to its target of 2%.

- Gold continues to shine. The Chinese Central Bank has been buying gold in an attempt to diversify away from the dollar. Gold prices may hit a period of consolidation as the Chinese Central Bank cuts back on buying gold at these price levels.

Outlook & Positioning

Lot’s of talk about bubbles out there. Jeremy Grantham of GMO is back in the headlines, calling this a super bubble.

He makes a reasonable argument that might otherwise worry me if I didn’t know that he’s been saying that U.S. stocks were in a bubble every year since 2012. At least he’s consistent, lol.

Sadly, his investing track record makes it difficult to take his predictions too seriously. It’s hard to say how much he’s cost his clients over the years by avoiding U.S. stocks.

For our part, we remain overweight U.S. stocks and tech stocks, in general. We did add Indian stocks to the portfolio this year, however.

The Federal Reserve Bank has emphasized that they intend to lower short-term interest rates three times in 2024, yet interest rates, Treasury Inflation-Protected Securities, energy prices and gold indicate a different expectation.

Given that housing costs make up 40% of the Consumer Price Index, it’s hard to believe that inflation is going down to the FED’s 2% target any time soon, and it seems that bond and gold investors are picking up on this. That’s reason enough for us to avoid intermediate and long-term government bonds despite the most attractive yields we’ve seen in years.

Regarding the stock market, I’m fully expecting turbulence at some point this year, especially with the election. That’s not a reason in and of itself to become defense, however. Just look at how the markets reacted after the last two elections if you’re worried about it.

As I pointed out in last quarter’s letter, good years tend to cluster together. Presently, we are in an environment where we need to continue playing offense while the opportunity still exists.

There will always be bumps in the road, but we care about avoiding disaster (federal debt crisis???), and there is nothing to indicate we are headed over the cliff…yet.

Miscellaneous

As a financial advisor, it’s all too common to focus solely on the figures rather than considering the personal aspects of an individual’s retirement plan.

I thought I would share this touching article with you about a pilot who chartered an Airbus to take his 112 closest friends and family to Hawaii for his retirement party.

He spent a good chunk of change to do this, but he says: “You can’t put a price on something that was that big. You think about being able to go out that way and take all your family and friends on a whirlwind journey. You don’t want to be the richest man in the graveyard one day.”

Well said.

By the way, if you are my client, and you are thinking about doing something like this, let’s at least have a discussion on how it would impact your retirement plan. ?

Steven Neeley, CFP® is an investment advisor representative of and offers investment advisory services through Fortress Capital Advisors LLC, a registered investment advisor offering advisory services in the State of Indiana and other jurisdictions where registered or exempted.

Sources

The return data for the indexes in the table comes from PortfolioVisualizer.com, an online software platform for portfolio and investment analytics