A Practical Guide To Managing Risk In Your Portfolio

Traditionally, both wealth managers and institutional investors such as pensions and endowments manage risk through diversification, commonly taking the form of asset allocation at the portfolio level - owning different asset classes such as stocks, bonds, commodities and real estate.

Managing risk using asset allocation has an intuitive appeal. After all, if one asset class, say, stocks, performs poorly, other asset classes may perform well, bolstering performance.

Consider your investment portfolio as a garden. Asset allocation is akin to planting different types of plants like trees, flowers, vegetables and fruits. This diversified garden gives you protection against different types of weather. If the weather is too harsh for the flowers, you might still have healthy vegetables or trees.

However, an extreme weather event such as a severe drought, can lay waste to all types of plants at the same time, similar to financial crises and bear markets that cause most asset classes to decline in value simultaneously, inflicting potentially catastrophic losses on portfolios. The 2008/2009 financial crisis, the Covid crisis, and the market downturn of 2022 are all recent examples of this.

Top wealth managers and institutional investors are well aware of this problem, which is why they employ multiple methods beyond asset allocation to manage risk. In other words, they don’t just diversify their plant types. They also employ other risk management methods, think purchasing crop insurance, to safeguard their gardens from disasters.

This article outlines the most common risk management techniques and investments used by top investors: safe haven assets, hedged strategies, strategic rebalancing, drawdown limits, volatility targeting, and tail risk hedging.

We finish by reviewing techniques that can be used by everyday investors, not just professionals.

Risk Management Techniques Used By Professionals

- Owing Safe Haven Assets

Assets that tend to do well during crises and periods of extreme market stress such as gold and other precious metals can be thought of as safe-haven assets.

Gold has a history as a safe haven asset that stretches back millennia (Spitznagel 9). It tends to do particularly well during periods of high inflation, as well as during financial crises. Investors that specialize in what is known as global macro investing often use gold as a risk management tool precisely for its safe haven characteristics.

- Investing in Hedged Strategies

There is a wide range of hedged investment strategies, making it difficult to provide an exact definition. For our purposes, they can be thought of as investment strategies that attempt to profit not just when security prices rise, but also when they fall.

Imagine you're at a casino playing both red and black in roulette to minimize your losses. Hedged strategies work in a similar way - they try to make money when investments are both rising and falling. Think of them as a safety net that limits the impact of bad investment decisions. Contrast this with the typical mutual fund that only profits if the stocks that it owns increase in value.

Studies show that two hedged strategies in particular, market-neutral and managed futures, are especially effective at helping investors manage risk in a portfolio without trading off too much upside. (Neville et al. 2)

Market-neutral funds tend to do very well in recessions as the ‘quality’ companies they invest in usually outperform the ‘junk’ companies that they bet against (Asness 45).

Managed futures funds, on the other hand, do well during periods of stress because they are able to profit off downtrends in markets.

- Strategic Rebalancing

Think of rebalancing as adjusting your exercise routine. If you set out to spend 60% of your time on cardio and 40% on weight training, but notice you're doing more cardio, you'd have to cut back on running and spend more time lifting to regain balance. Rebalancing investments works in the same way, helping maintain your desired financial 'fitness' level.

Why do this?

The simple answer is to control for position size. A portfolio that begins as 60% stocks/40% bonds would come to be dominated by stocks over the course of several years given how much stocks tend to outperform bonds over time. That same portfolio may eventually have an allocation of 75% stocks and only 25% bonds, leaving it susceptible to much larger losses during a bear market than originally anticipated.

In practice, many investors rebalance over set intervals such as quarterly or annually. Research shows, however, that naively rebalancing like this can exacerbate losses during market downtrends (Harvey et al. 108). Selling winners to buy losers during a prolonged bear market means you are continually throwing good money after bad.

Harvey and colleagues (109) show that using rules-based trend-following strategies to make rebalancing decisions greatly improves outcomes by reducing losses. Sophisticated investors understand this, and thus take a strategic approach to rebalancing, waiting for changes in market trends before executing.

- Setting Drawdown Limits

One of the most common and effective risk management techniques employed by professional traders is setting drawdown limits on the maximum loss allowed over a certain period.

This is like setting a maximum budget for a shopping trip. If you set a limit on how much money you can lose on a particular investment, you'll automatically stop investing once you hit that limit. It's like an emergency stop button that can prevent you from a financial crash.

Traders can set stop-loss orders on the stocks they own. These orders automatically execute if the price falls below a specific threshold. For example, the investor may decide that a 10% loss is the maximum he/she is willing to tolerate. If a stock currently trades at $100 per share, the investor will set the sell order to execute at $90.

Institutions and multi-strategy hedge funds, on the other hand, often set maximum drawdown limits on managers as a means of controlling risk, firing them if limits are breached.

- Volatility Targeting

Stock prices are like a roller coaster, sometimes going up, sometimes down. Volatility targeting is a strategy that cuts back on investments when the ride gets too rough and increases them when things smooth out again.

Over time, U.S. stocks have averaged roughly 7% per year in price appreciation (excluding dividends.) Assuming 252 trading days in a year, that equates to an average daily price return of almost .03%.

Of course, stock prices don’t move up by the same amount day after day. Rather, they fluctuate between gains and losses.

Statistically, daily returns should fall between about 1.1% and -.9% two-thirds of the time. Yet, there are times when daily returns fall well outside of these bounds, fluctuating by 3%, 5%, or even 10% in a single day. This is what is referred to as high volatility.

There are two important things to know about high volatility: a.) High volatility in the recent past tends to be followed by high volatility in the near future. b.) During periods of high volatility, stock market returns tend to be far more negative than positive (Harvey, et al. 72).

Volatility targeting serves as a potent risk management strategy, reducing weights in assets experiencing volatility spikes to reduce loss severity. As volatility returns to normal levels, assets are reintroduced to the portfolio.

- Tail Risk Hedging

Understanding the definition of tail risk involves at least a basic understanding of statistics, so we will attempt to simplify the concept for you.

Imagine you're driving to work every day over a well-maintained bridge. Most days, your biggest worry is normal traffic or a flat tire—everyday problems you know how to handle.

But what if one day, as you're crossing, the bridge unexpectedly collapses? It's a rare event, so rare that it probably never even crossed your mind. But if it did happen, the results would be disastrous.

In finance, "tail risk" is like that bridge collapsing. It's the risk of a very extreme, unpredictable event that, if it were to occur, could have severe impacts on your investments. It's a rare event, but because the effects can be so damaging, it's something investors try to prepare for, just in case. A perfect example of tail risk in the financial markets is the Covid-19 pandemic in 2020.

Think of tail risk hedging as buying fire insurance on your home. The chances of a fire are low (tail risk), but if it happens, the damage could be huge. So, you have insurance (hedging strategies) in place, hoping you never need to use it, but it’s there, just in case.

Purchasing put options (essentially stock market insurance) on the stock market or implementing volatility exposure strategies that profit when volatility surges are two common and effective strategies for managing tail risk (Ng 3)

Risk Management Techniques for Everyday Investors

What we’ve outlined so far are common techniques used by investment professionals, many of which aren’t exactly easy to pull off for ordinary investors. The good news, however, is that ordinary investors can borrow and simplify many of the concepts mentioned above to make sure that they can weather most financial storms.

- Invest in gold exchange traded funds

We mentioned owning safe haven assets like gold in the first section. The good news is that it is very easy to get exposure to gold without having to physically own it. (Side note: Don’t get duped into believing that owning physical gold is superior. If your biggest concern is the collapse of society, a la a Mad Max type scenario, you will be far better off becoming a Doomsday Prepper than you would hoarding physical gold.)

There are exchange traded funds (ETFs) that track the price of gold while buying and storing the physical gold that underlies the price. Remember, your buying gold ETFs because gold is a great diversifier and it tends to do well during financial crises and periods of high inflation, not because you believe society is going to collapse.

The amount you want to own in your portfolio will vary depending on your circumstances, but we’ve seen good arguments for allocations between 5% and 20% (nothing in this article is a specific recommendation!). We tend to hold less for our clients but that is because we take a multifaceted approach to risk management and have found that we simply don’t need to hold that much.

Before you decide, make sure you understand clearly why you want to own gold in your portfolio. Additionally, be aware that the price behavior of gold can be volatile and vary significantly from stocks. You need to make sure that you are OK with this.

- Hold cash

While it might not earn much, there is a lot of wisdom in holding a certain amount of cash. Number one, its value will remain steady while you watch the value of your other investments drop. That’s a big psychological benefit that can help you ride out a bear market without panicking and selling at the bottom.

And for the intrepid, cash gives you the ability to go bargain hunting when there’s “blood on the streets.”

- Use Stop Loss Orders

A stop loss order instructs your brokerage to sell a security when it reaches a specified price. It can help limit losses by automatically selling when the price drops to a certain level. It can also help investors stick to their investment plan by automatically selling when the stop price is reached, preventing emotional reactions to market fluctuations.

*Note that there are limitations and risks that go along with using any type of stop loss order, so we suggest conducting your own research on different order types, as well as their pro and cons before using them.

- Use Trend Following Techniques

Where most investors fail is jumping in and out of markets based on emotional reactions rather than having well-defined plans. We know several people who sold during the financial crisis after losing 20-25%, which felt pretty good as the market went on to tumble another 30%. The problem was that they sat on the sideline for years with no clear signal to get back in. They remained paralyzed with fear as the stock market kept rising while the economy remained on shaky ground. Having a well-defined plan with triggers for exactly when to buy and sell can help you avoid paralysis, and hopefully, let you rest easy knowing you have a plan in place.

This is where trend following can come in. Trend following as an investment strategy is a pretty straightforward concept: find a wave, ride it, and get off before it crashes. In academic literature, the technical term is time-series trend following and it is related to momentum investing, one of the most studied and highly successful trading strategies ever studied.

Studies show that trend following is particularly effective in protecting against market crashes and against inflation. (Hamill et al. 15) (Neville et al. 4) What’s more, a 2016 study showed that trend following techniques can be used to increase withdrawal rates by up to as much as 50% per year. (Clare et al. 1)

A simple example of trend following strategy would be looking back on the past 12 months of the S&P 500 total return at the end of every month. If the return is negative, sell and go to cash. If the return is positive, invest in an S&P 500 index fund. Research indicates that simple rules like this can meaningfully reduce losses.

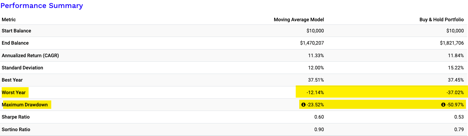

Here’s a table showing the results of this strategy from 1978 through the middle of 2024:

Those are some pretty compelling results. You would have captured nearly the entire return, yet experienced less than half of the worst loss, -23% versus -50%.

Note: the illustration does not include transaction costs or factor in taxes, so this strategy is far less compelling if done in a taxable account. Still, as part of a comprehensive risk management plan, it’s worth considering. Just remember to do as much research as possible and be careful to consider the trade-offs.

Conclusion

Risk management requires a multifaceted approach that incorporates both traditional methods such as asset allocation, and more advanced strategies, including owning safe-haven assets, investing in hedged strategies, strategic rebalancing, setting drawdown limits, volatility targeting, and tail risk hedging. Adept management of risk requires the creation of a comprehensive program that balances the strengths and weaknesses of each method against their potential costs.

While risk management cannot completely eliminate the potential for loss, it can significantly curtail it, providing stability to portfolios and enabling them to weather economic downturns, volatility, and extreme, unforeseen events or tail risks. Embracing a comprehensive risk management strategy is not just beneficial, but fundamental to ensuring the sustained growth and resilience of an investment portfolio. The challenge lies in understanding these methods, implementing them wisely, and adapting them in response to the ever-evolving financial landscape.

Disclosures:

The contents of this article should not be construed as legal, tax, investment, or other advice. Many factors affect investment performance, including changes in market conditions and interest rates and in response to other economic, political, or financial developments. Future returns are not guaranteed and a loss of principal may occur.

The results of the trend following table were derived using Portfolio Visualizer software and are believed to be accurate. They do not include trading costs or taxes. They also assume that trades are placed at the end of the day on the first day of each month, which may not be possible in the real world. None of the strategies mentioned in this article should be taken as an endorsement and instead are provided for educational purposes only.

This communication is not to be directly or indirectly interpreted as a solicitation of investment advisory services.

References

Asness, C., A. Frazzini, and L.H. Pedersen. Quality Minus Junk. Review of Accounting Studies. 2019

Clare, Andrew D., Seaton, James, Smith, Peter N., and Thomas, Stephen H. "Absolute Momentum, Sustainable Withdrawal Rates and Glidepath Investing in US Retirement Portfolios From 1925." CAMA Working Paper No. 31/2019, April 3, 2019. [Link](https://ssrn.com/abstract=3365338)

Donnelly, Brent. Alpha Trader: The Mindset, Methodology and Mathematics of Professional Trading. Brent Donnelly. 2021

Hamill, Carl, Rattray, Sandy, and van Hemert, Otto. "Trend Following: Equity and Bond Crisis Alpha." SSRN, August 30, 2016. [Link](https://ssrn.com/abstract=2831926)

Harvey, Campbell R.; Rattray, Sandy; Van Hemert, Otto. Strategic Risk Management. Wiley Finance. 2021

Ilmanen, Antti. Expected Returns: An Investor’s Guide to Harvesting Market Rewards. Wiley. 2013

Lo, Andrew W. Adaptive Markets. Princeton University Press. 2017

Moskowitz, Tobias J., Ooi, Yao Hua, and Pedersen, Lasse Heje. "Time Series Momentum." Chicago Booth Research Paper No. 12-21, Fama-Miller Working Paper, September 1, 2011. [Link](https://ssrn.com/abstract=2089463)

Neville, Henry and Draaisma, Teun and Funnell, Ben and Harvey, Campbell R. and van Hemert, Otto, The Best Strategies for Inflationary Times. 2021. Available at SSRN: https://ssrn.com/abstract=3813202 or http://dx.doi.org/10.2139/ssrn.3813202

Ng, Timothy, “The Power of Tail Risk”. The Hedge Fund Journal 2013: https://thehedgefundjournal.com/the-power-of-tail-risk/

Spitznagel, Mark. Safe Haven. Wiley. 2021