Retirees: Avoid This Roth Conversion Mistake at All Costs

Introduction

A client recently sent me an article in MarketWatch where a reader asked if he should convert his $1.3 million IRA into a Roth IRA.

“Does it make sense to do a massive roll-over of the IRA to a Roth IRA and pay the taxes now when my income is low? I had a guy run the numbers and it is mostly a wash.”

Umm. What? A wash?

Let me tell you, converting that amount is almost certainly a dumb idea, though I’m not surprised someone suggested it. I have client who, before he started working with me, had a financial advisor suggest he convert a similar amount.

Sadly, there’s a lot of bad advice out there about Roth conversions. People get hung up on the fact that they will be forced to take required minimum distributions (RMDs) from their IRAs or 401(k)s at some point and many unscrupulous financial advisors are more than willing to play into their fears about paying taxes. The big solution they often pitch is the Roth conversion.

What is lost on many people is that Roth conversions aren’t a way of avoiding taxes completely but simply a way of reducing the total amount of taxes paid over time… If done strategically.

Many retirees have socked away hundreds of thousands, if not millions of dollars into tax-deferred retirement accounts such as an IRA or a 401(k).

If this is you, great. But recognize that you are sitting on a massive tax liability that will hit you once you start withdrawing from those accounts. Worse, you will be forced to take a required minimum distribution annually starting at either age 72.5 or 75 depending on when you were born.

I call this situation being in “pensioners’ prison”, a place all retirees want to escape from their tax liability.

The good news is that there are ways to break out of pensioners’ prison, and we are going to talk about them in this article.

The Kool-Aid Man Method

When creating his escape plan, The Kool-Aid Man doesn’t care at all about strategy, details, etc. He has one simple goal: busting through the walls to get out. Effective? Absolutely. But it’s probably not in his long-term interest since a noisy jailbreak just increases the chances that he’ll be back behind bars in no time.

This is a lot like doing a million dollar plus Roth conversion to avoid the dreaded RMD. You bust out of prison briefly since you have reduced the taxes you would have paid on RMDs, but you are headed right back since you are likely going to pay even more in taxes than you would have by simply taking the RMDs. Even if you don’t pay more in total taxes over time, you still might be worse off due to having a lower net worth.

Let’s take a look at a couple of examples using my financial planning software and a real-life client.

The client (name withheld for privacy purposes) is in his mid 60’s and will retire when he hits full retirement age for Social Security. The software assumes that tax rates increase in 2026, reverting to the pre-Trump tax cut levels.

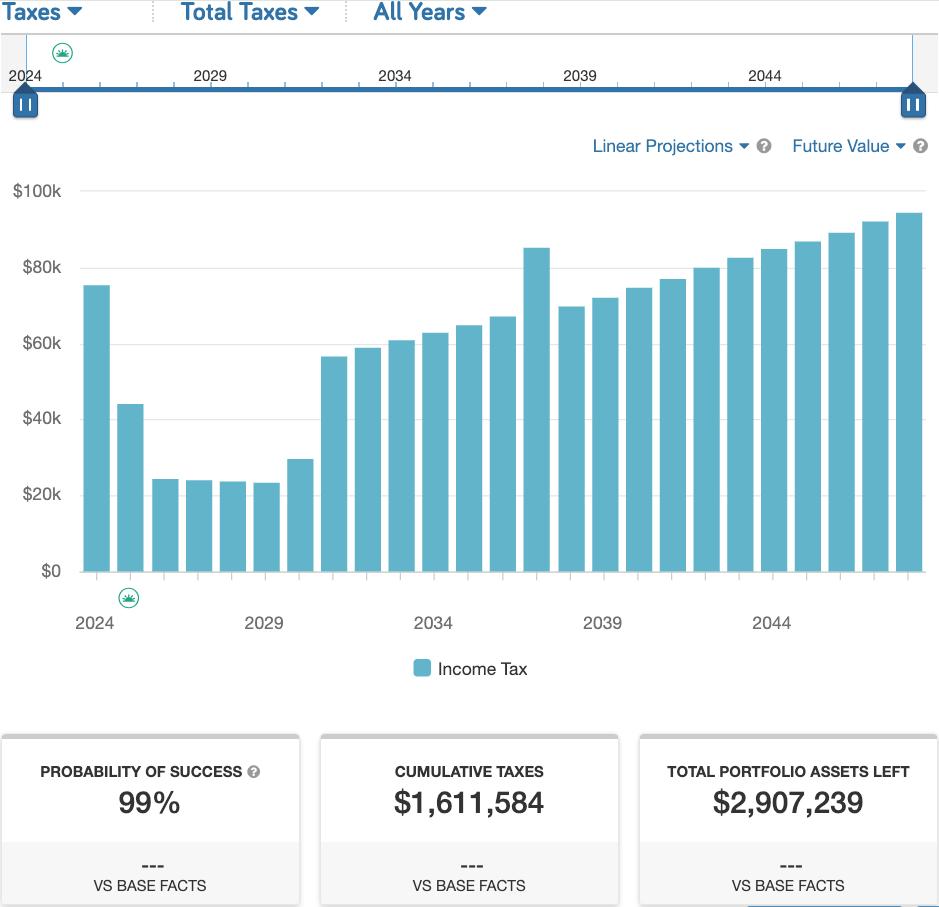

Here’s what the tax picture looks like assuming no Roth conversion.

Notice that amount paid in taxes is pretty consistent once RMDs begin after 2030, which makes sense. Most retirees with large tax-deferred accounts will follow this path. In this client’s case, he will pay more than $1.6 million in taxes if he lives to 90.

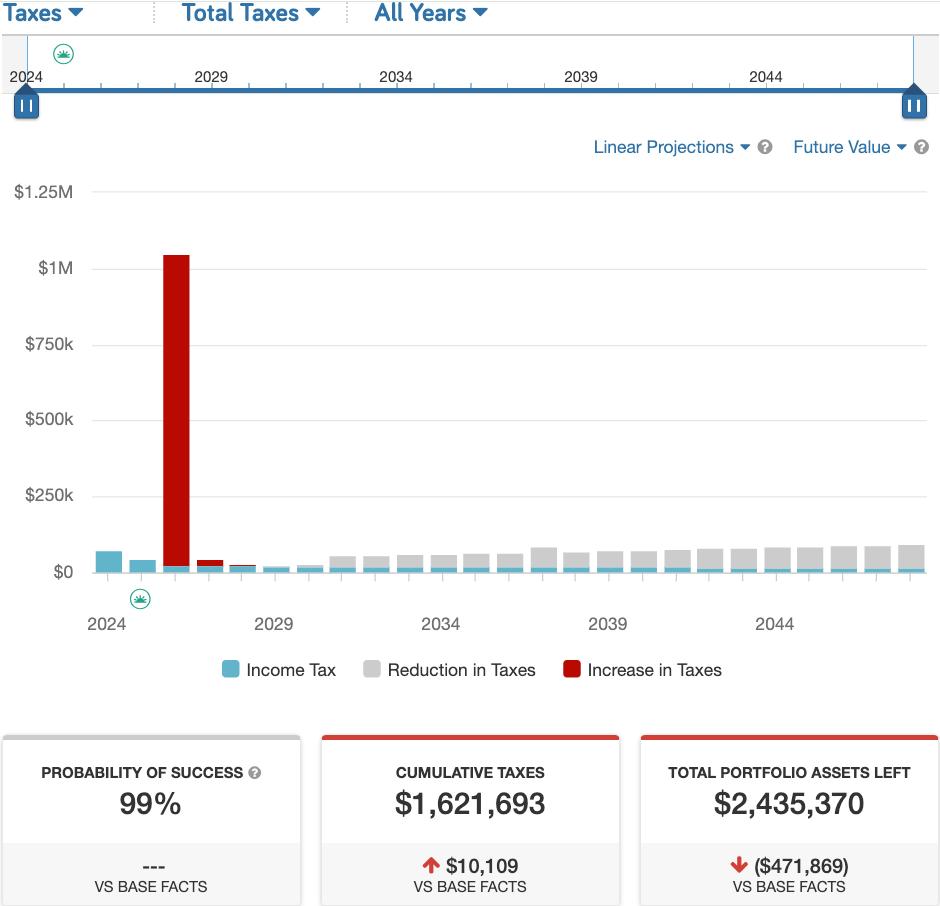

Now here is what it looks like assuming that he converts $1.3 million of his IRA all at once.

The contrast is striking. He paid a massive amount of taxes upfront just to get the steady reduction (gray bars) over time from the taxes that would have been paid because of having to take RMDs.

Also, notice that he pays $10k more in total taxes over the entire time span. The more important observation, however, is that the total value of assets remaining at age 90 is $471k less because of the conversion.

He faces significant financial penalties due to his New York City residence, where steep state income and local taxes combine to create an unusually high tax burden.

Not only that but the conversion puts him in a situation where he must pay both the Medicare surtax and the Net Investment Income Tax since his modified adjusted gross income was pushed over the thresholds for those two taxes.

Oh, and since he will be taking Medicare at the time, he is forced to pay higher premiums through the Income Related Monthly Adjustment Amount (IRMAA).

All in all, The Kool-Aid Man method makes no sense for this client.

The Shawshank Redemption Method

In the Shawshank Redemption, Andy Dufresne meticulously a tunnel through the walls of Shawshank Prison over many years, finally gaining his freedom.

You can take a similar approach with Roth conversions. Rather than doing a massive conversion up front, it usually makes more sense to do regular conversions over several years.

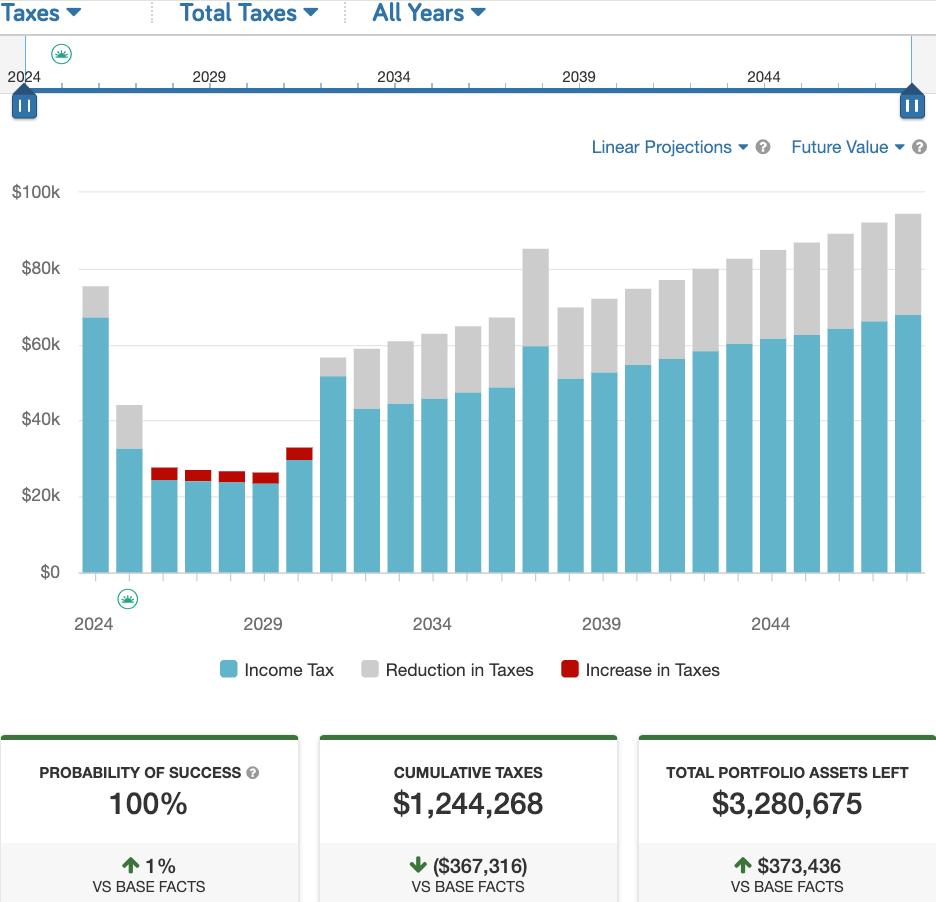

In our example below the same client does $35k annual conversions over a five-year period rather than the massive one-time conversion.

Quite the contrast with the Kool-Aid man method, right? Two things immediately jump out: 1. He pays far less in cumulative taxes. 2. He increases the ending value of his portfolio assets by nearly the same amount that he saves in taxes, roughly $370k.

What’s driving the difference in outcomes between the two methods?

It essentially boils down to all the money he spent upfront on taxes using The Kool-Aid Man method, money that would have otherwise been invested and growing over time.

Does It Ever Make Sense to Do a Large Conversion?

In some cases, converting a large amount to a Roth makes sense. For example, if your business has a big net operating loss, you could use that loss to offset the extra income from the Roth conversion.

Another situation in which a large one-off conversion probably makes sense is if you intend to make large charitable donations. You could use those to offset the taxable income generated by the conversion.

Conclusion

There are numerous variables that can alter the outcome of a Roth conversion analysis, including life expectancy, relocation to a state with lower taxes, rises in federal tax rates, and investment returns, just to name a few.

I ran the same analysis above on a different client who lives in a different state and got a very different outcome. Surprisingly, he would not benefit from either the Kool-Aid Man method or the Shawshank redemption method; he’s simply better off not doing Roth conversions due to his unique circumstances.

I can’t emphasize strongly enough how important it is to run a thorough Roth conversion analysis that considers your unique situation before doing the conversion. Small changes in the assumptions can make a big difference in the result.

In conclusion, the decision to undertake a Roth conversion is not one-size-fits-all and can result in vastly different outcomes depending on individual circumstances. While The Kool-Aid Man method involves a significant upfront tax payment with the intention of securing lower taxes and avoiding RMDs later on, it can lead to a substantially reduced asset values. This method can also trigger additional tax burdens such as the Medicare surtax and higher premiums through IRMAA due to an increased modified adjusted gross income.

On the other hand, the Shawshank Redemption method—a gradual approach to Roth conversions—can result in lower cumulative taxes and a corresponding increase in portfolio value, benefiting from the potential growth of the money that would have otherwise been paid in taxes.

Ultimately, the effectiveness of Roth conversions depends on numerous variables, including life expectancy, state of residence, federal tax rates, and investment returns. A comprehensive and personalized Roth conversion analysis is crucial, considering all relevant factors to determine the most beneficial strategy.

Don’t hesitate to reach out to me if you want to see about running a Roth conversion analysis to see if it makes sense given your specific circumstances. You can book a no-cost consultation with me on my website or by using this link: Calendar Link.

Cheers,

Steven

Sources

Important Information

Investment advisory services are offered through Fortress Capital Advisors LLC, a fee-only, fiduciary registered investment advisor. This communication is not to be directly or indirectly interpreted as a solicitation of investment advisory services.

The contents of this communication are not to be copied, quoted, excerpted or distributed without express written permission of the firm. Any other use beyond its author’s intent is strictly prohibited. Nothing on this website is intended as legal, accounting, tax or investment advice, and is for informational purposes only.