Market Update August 2022

There was a period during 2020 and 2021 spanning about 6-8 months in which the financial markets seemed to go up nearly every day regardless of how poor the economic data or Covid counts were. I miss those days. Maybe we can hold a vote to bring them back because 2022 has just been awful so far.

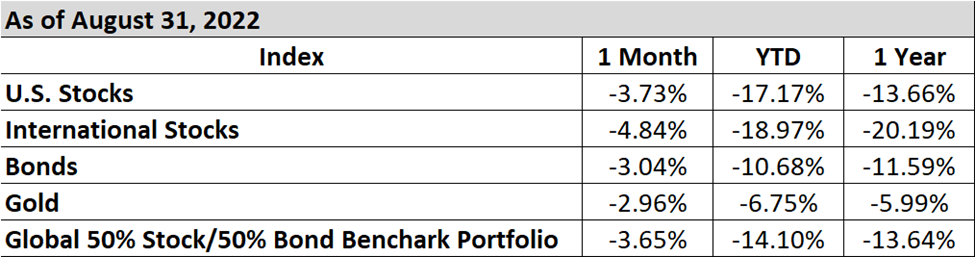

For August, stocks finished in the red. Again. That’s 5 of 8 months in the red so far this year, and in one of the three months that wasn’t negative, stocks were flat, which pretty much counts as negative in my book.

Most investors expect stocks to go down from time to time, but what’s been most difficult to digest is that bonds, the typical safe haven asset class, are down double digits for the first time since 1973

How did we get here?

- Inflation, but more importantly, inflation coming in hotter than expected.

- The Ukraine War – the war exacerbated inflation, in addition to souring sentiment around global growth, with the biggest impact being felt in Europe.

- China’s zero Covid policy has crimped growth in the world’s second-largest economy, which in turn has hampered growth in much of East and Southeast Asia.

- Perhaps the biggest contributing factor to market losses has been the fear that the Federal Reserve Bank is going to commit a major policy error by hiking interest rates to quell inflation so aggressively that the economy crashes.

Portfolio Positioning

- On May 9th, we got the signal to become more defensive and have remained that way since. According to our research, the worst market outcomes have always come during periods in which the market indicators we use are at levels similar to today’s.

- We are significantly underweight international stocks given the dire energy situation in Europe, in addition to China’s dedication to a zero Covid policy.

- For bonds, we are shunning credit risk given our view that we are likely headed for a recession at some point in 2023, yet corporate bond prices don’t currently reflect this risk.

- To combat inflation, we continue to invest in commodity trading strategies that can benefit from increased commodity prices.

All in all, there’s a lot of uncertainty out there, and while the data call for a defensive stance here, they also don’t indicate any reason to be in a full-on panic. In particular, the employment numbers remain robust and provide a reason for optimism. As always, we are data-driven and will be ready to change our positioning as circumstance dictates. For now, that means being moderately defensive.

Miscellaneous

It’s great to be back in Indiana. Having been away for so long, I had forgotten how beautiful this state is, especially the southern part.

Julia, Aiden and I rented a cabin down at McCormick’s Creek State Park for the weekend, which was a wonderful getaway. If you haven’t been, I highly recommend it. The park has miles of hiking trails, a beautiful creek with waterfalls that kids can play in, and even activities like horseback riding.

I know it’s tough staying sane in a world that is becoming increasingly chaotic and feels like it could fall apart any minute. My advice: turn off the news and spend some quality time with family or friends outdoors while the weather still permits. We are truly blessed to live in such a beautiful country.

As always, feel free to get ahold of me if you’d like to discuss the financial markets in more detail, or if you have any other questions or concerns for that matter. Take care.

Yours, Steven

Steven Neeley, CFP® is an investment advisor representative of and offers investment advisory services through Fortress Capital Advisors LLC, a registered investment advisor offering advisory services in the State of Indiana and other jurisdictions where registered or exempted. Main office: 4841 Industrial Pkwy, #139, Indianapolis, IN, 46226. Tel: (317) 210-3727.

Sources

The return data for the indexes in the table comes from PortfolioVisualizer.com, an online software platform for portfolio and investment analytics.